Unlock Cash by Pawning Your Car Today

Registered credit provider offering transparent, short-term loans against your vehicle.

How It Works: Unlock Cash with Your Car

If your car is fully paid off and registered in your name, you can unlock its value

by using it as security for a short-term, asset-based loan—without having to sell it.

How it works

Drive Your Financial Freedom

with Our Simple Car Loan Process

Loan Period

Minimum repayment period: 1 TCA (Total Contractual Amount)

Maximum repayment period: 3 TCA

• The client agrees to pay the Capital Debt + Interest + all Costs quoted and accepted in this Pawn / Loan Agreement, within 62 days, or as negotiated between the parties.

• The client and the company hereby agree that the period of the loan may be extended at the sole discretion of the company, BUT ONLY, when and if the total outstanding amount has been paid by the client.

• No discount will be given for early payment.

APR (Annual Percentage Rate) & Fees

• Max. 6% APR

• Storage fees (at rate of 25% per month)

We do not 'Pawn while you drive'. We store your car safely until repayment.

We DO NOT BUY cars/ vehicles.

Online Application

testimonials

Genuine Reviews From

Satisfied Customers

Great service from Cadie always willing to help with a big smile. Highly recommended.

1000% Service.. would go over and over again to purchase. Friendly and open hearted. Assisted by Cadie

Great service everyone was so amazing very well organized team!!!

Frequently Asked Questions

Need Cash Fast?

Common Car Pawn Questions Explained

How long is the payment period?

The minimum repayment period for your loan is 1 TCA (Total Contractual Amount), while the maximum repayment period extends up to 3 TCA, giving you flexibility to manage your repayments according to your financial situation.

What is your interest rate?

Our interest rates are aligned with national rates and fully comply with the guidelines set by the National Credit Regulator (NCR), ensuring fair and transparent lending for all our customers.

I still owe money on my car. Can I pawn it?

No. To pawn your car, the vehicle must be fully paid off. Until then, it isn’t entirely yours, and the bank retains a financial interest in it, which prevents it from being used as collateral.

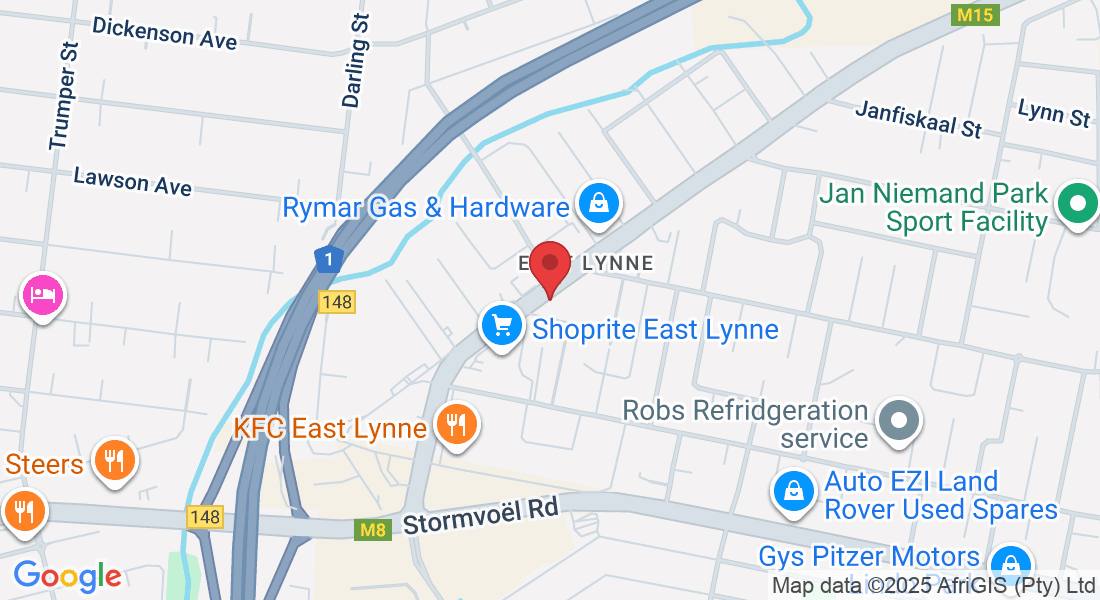

Where can I pawn my car for cash?

At Pawn Your Car Quick, we provide fast and discreet cash loans against vehicles at our Pretoria branch. Our process is simple, transparent, and designed to get you cash quickly without any hassle.

Is the Loan Process Discreet?

Yes. All our loans are completely private and discreet, handled by appointment only. We never share your information with credit bureaus or any third parties, ensuring your privacy is fully protected.

What is out admin and storage fees?

Our admin fee is 5% of your loan amount, covering the processing of your application. While your car is held, a storage fee of 25% per month applies to ensure your vehicle is kept safe and secure.

Credentials:

Pawn Your Car Quick (Pty) Ltd is a registered credit provider (NCRCP21665)

At Pawn Your Car Quick, we are committed to providing trusted car pawn solutions that help you access fast, reliable cash. Our dedicated team is here to guide you every step of the way, offering flexible lending options tailored to your needs.

Quick Links

Contact Us

Legal

Pawn Your Car Quick (Pty) Ltd is a registered credit provider (NCRCP21665)

© Pawn Your Car Quick 2026 All Rights Reserved.